It was a rainy summer morning, not all that long ago. I made my way down to the little coffee shop at the base of my building as I did every morning, my limbs heavy, my movements sluggish, my nervous system screaming out for the coffee it so desperately craves. It’s rush hour, and the queue, although moving, seems somewhat overwhelming. As the queue meanders towards the counter, I start listening in to the conversation taking place between what I assume must be two colleagues making a coffee run before work. The distinctly British lady draped in a camel trench coat talks loud and brashly about her troubles finding an apartment in London to her Afrikaans colleague, whom I wouldn’t say seemed disinterested but most definitely needed a coffee as badly as I did.

“You know it’s ridiculous out there to find an apartment. It’s not just that it’s expensive. What I pay here in Cape Town could get me something that looks like a closet back home. I went for a viewing, and when I got to the apartment, there were already 30 people there, so I just left. My boyfriend and I realised that if we liked a place, we had to offer the landlord more money than the property was listed for, and never less than an extra £200 a month.” I remember sitting there with my fancy little coffee and having that last bit repeatedly play in my head. You have to offer the landlord more than the apartment is listed for just for the opportunity to actually have a space to live in. What kind of absolute Capitalist cost-of-living crisis hellhole had the world become?

Repulsed by the state of affairs, I retreated back to my apartment, luxury coffee in hand. With each sip, the story from downstairs seemed more and more dystopian. “Ahh, that’s just first-world problems,” I thought. Well, that is until I confirmed that I was moving back to Johannesburg. The apartment I had been living in was listed the next morning, and the rental agent asked if some potential tenants could come and view the property. Sure, how bad can it be? There were 25, yes, 25 different people meandering in and out, desperately trying to secure an apartment that, to anyone with any financial savvy (me not included), is ridiculously overpriced.

It’s no secret that financially, the world is in a bit of a precarious position at the minute. “The cost of living crisis” is a phrase that you may have seen pop up quite a bit in developed economies such as the US and UK and much of Europe, but that same crisis is on our doorstep. Our situation is already that of a pretty devastated economy that was already on the ropes from pirates parading as politicians, freely plundering and pillaging a stagnant economy hooked up to life support, but what do I even mean by the cost of living crisis as it stands right now?

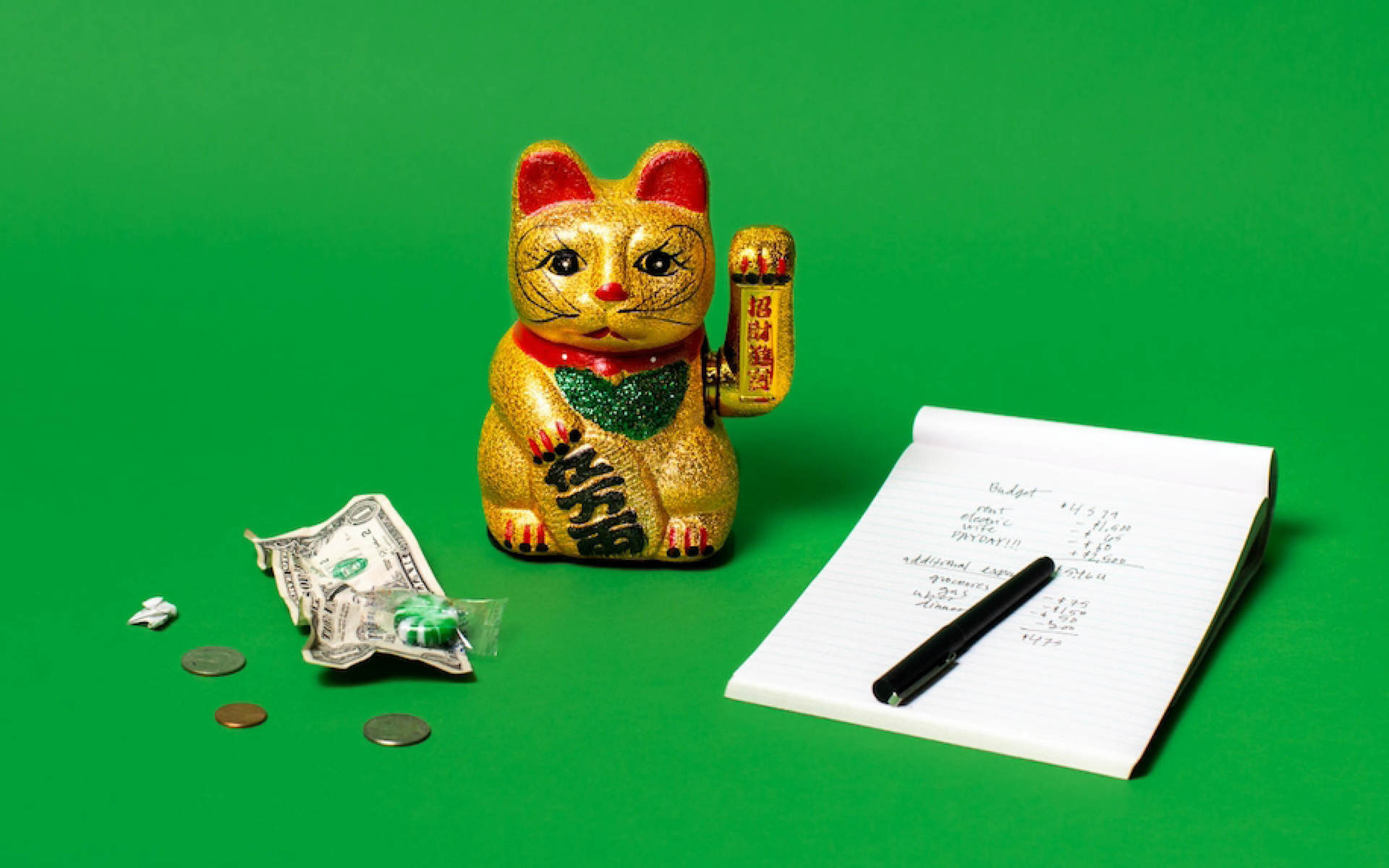

Simply put, it refers to “a situation in which the cost of basic, essential items such as food and energy bills have increased rapidly in a short period of time, and much faster than average household wages.” So essentially, inflation is absolutely out of control, which means that the meticulously planned monthly budget that got you through the month last June is leaving you with cents, if anything at all, in the current climate. What’s happening globally, however, shouldn’t be confused with lifestyle creep in which we gradually spend more and more as our salaries grow. No, this is very much a case of our habits and routines not changing but our bank balances at the end of the month being in an absolute chokehold.

Now I know it isn’t sexy to bring up stats and figures, but this is just one of those topics that need those statistics to illustrate to an extent just how dire the situation is. First and foremost, it is crucial to note just how sluggish the South African economy has been in terms of growth. Just recently, the South African Reserve Bank (SARB) slashed the economic growth forecast for 2023 from an already pitiful 1.1% to an alarmingly low 0.3% (healthy economies grow at around 2-3% a year). So we have a practically stagnant economy, all while prices of essential goods are skyrocketing. Helena Wasserman writes in her piece that the cost of living crisis in SA can be attributed to a handful of key sectors. The first is fuel prices which are reaching eye watering levels amongst a weak Rand compared to the dollar and the ongoing Ukrainian-Russian conflict. Transport hikes, travel cost increases, and aeroplane ticket increases have been hit hard.

Now I know it isn’t sexy to bring up stats and figures, but this is just one of those topics that need those statistics to illustrate to an extent just how dire the situation is. First and foremost, it is crucial to note just how sluggish the South African economy has been in terms of growth. Just recently, the South African Reserve Bank (SARB) slashed the economic growth forecast for 2023 from an already pitiful 1.1% to an alarmingly low 0.3% (healthy economies grow at around 2-3% a year). So we have a practically stagnant economy, all while prices of essential goods are skyrocketing. Helena Wasserman writes in her piece that the cost of living crisis in SA can be attributed to a handful of key sectors. The first is fuel prices which are reaching eye watering levels amongst a weak Rand compared to the dollar and the ongoing Ukrainian-Russian conflict. Transport hikes, travel cost increases, and aeroplane ticket increases have been hit hard.

The next key factor is the massive increase in food prices, particularly staple foods such as wheat and maize, with 20 to 30% price hikes across the board, primarily due to the ongoing Ukrainian-Russian conflict, with the two nations being the biggest grain exporters in the world. In general, there was a 13% rise in food prices in the year to October, with meat going up by almost 10%. This is why that same basket of groceries at your favourite grocer seems so ludicrously expensive now. For example, the same coffee I was talking about earlier was R18 for a black Americano when I got to Cape Town in July of last year. However, this was short-lived as the price soon rose to R20 and then to R22 by the time I left. A R4 price increase doesn’t sound like all that much but take that R4 price increase on something that is bought as frequently as coffee, and the bigger picture becomes far clearer, particularly when you remember that not only coffee got more expensive, but practically everything in your shopping basket did.

Before the one that is obvious to all South Africans, there is also the point of massive interest rate hikes to combat high inflation levels. Although inflation fell to 6.9% in January, down from 7.2% in December (healthy economies hover somewhere around 1-3%), the interest rate is unlikely to come down until the Reserve Bank meets its inflation targets around 4.5%. So here’s the deal; South Africa generally has less money, but interest rates are so high that loan repayments have become an increasingly big concern for those that are just about making it through the month.

Finally, and we all knew it was coming, we needed to talk about electricity. Now, this is a topic that feels like beating a dead horse. Our energy crisis is severe, and it is intrinsically linked to many other economic concerns for our country. Loadshedding at Stage 6 costs the economy up to R900 million a day. That 0.3% growth forecast makes a lot more sense. Coupled with the fact that Eskom has applied for a 32% tariff hike in a service they can’t consistently provide, the situation seems almost comical. Please pay 32% more for the few hours we can provide you with electricity, and so that we can buy massive amounts of diesel to prop up the electricity supply because the power stations aren’t producing nearly at max capacity? I think all South Africans, regardless of socio-economic background, have had it with a shambolic husk of a state enterprise.

It’s not all doom and gloom, but we may need to change our own habits to combat the crazy curve of costs. For some, that means looking at our expenses and seeing which low-hanging fruit we could cut away. For example, those two-morning coffees at the coffee shop weren’t the wisest call, nor was my overreliance on Uber Eats when I was lazy, as some easy-to-achieve examples. This may also be the right time to have a peak back at that budget you set up. Now, this is not to clutch as pennies but to look at and evaluate the importance of what you spend money on. Maybe you can get slightly slower internet for cheaper, and maybe you hold off on your cell phone upgrade to save some extra Randela’s. Perhaps, as I decided, the price of that lovely apartment has reached a point where it isn’t worth it anymore. Maybe it’s time to get rid of some of that unnecessary clutter, and it’s pretty fun to have your model moment by styling all the unwanted pieces you’d want to get rid of, and setting up a Yaga page or attempting to navigate whatever weird, almost robotic conversations tend to happen when you sell furniture on Facebook Marketplace. Definitely, just some suggestions, which I’d take with a pinch of salt given that I’m also the person that blew their medical savings on a pair of Gucci glasses that I probably didn’t need. The point being, that while we may be in this situation simply by virtue of existing in this world; its a poignant reminder that working longer or harder cannot always protect us from economic cycles, and at some point we are required to make adjustments – however unfair this may be.

It’s hard and I can’t assure you all that it’s going to be okay because, frankly, I do not know. Just know that you aren’t going through this financial anxiety alone. We tend to be hard on ourselves regarding money and where we think we should be at different points in our lives. Still, in a world as unpredictable as ours, that has recently been through a global pandemic and seen a globally economically crippling war break out, I think this is really a case where we all should cut ourselves some slack. Quite a lot of this is completely out of our control, so let’s focus on the small things we still have control over – and as abstract as the economy itself seems, so too does it fluctuate, ebbing and flowing in the background while our lives invariably move on. We are as adaptive as ever because, well, we simply have to be.

Images: DTS, Money Bag$, Mackenzie Freemire.

Written by: Casey Delport

For more news, visit the Connect Everything Collective homepage www.ceconline.co.za